What HVAC System Qualifies for Tax Credit 2025?

Homeowners in Ohio have a fantastic opportunity to save money on new HVAC systems with federal tax credits available throughout 2025. If you’re considering upgrading your home’s heating or cooling system, it’s essential to know what HVAC system qualifies for tax credits in 2025 and how much you can expect to save. In this post, we break down the details of the federal tax credits available for air conditioners, heat pumps, furnaces, and water heaters throughout the United States. We also highlight additional utility rebates available in the Dayton, Ohio and Cincinnati, Ohio areas from CenterPoint Energy.

Understanding the HVAC Tax Credits for 2025

The 2025 federal tax credits for HVAC systems are part of the United States government’s Inflation Reduction Act, which aims to encourage energy-efficient home improvements. These credits are available for a wide range of energy-efficient upgrades, including air source heat pumps, central air conditioners, and gas furnaces. Note that federal tax credits are capped at $3,200 per year, so be sure to plan your upgrades accordingly. For more detailed information on the U.S. government’s federal tax credits and ENERGY STAR program, visit the ENERGY STAR website.

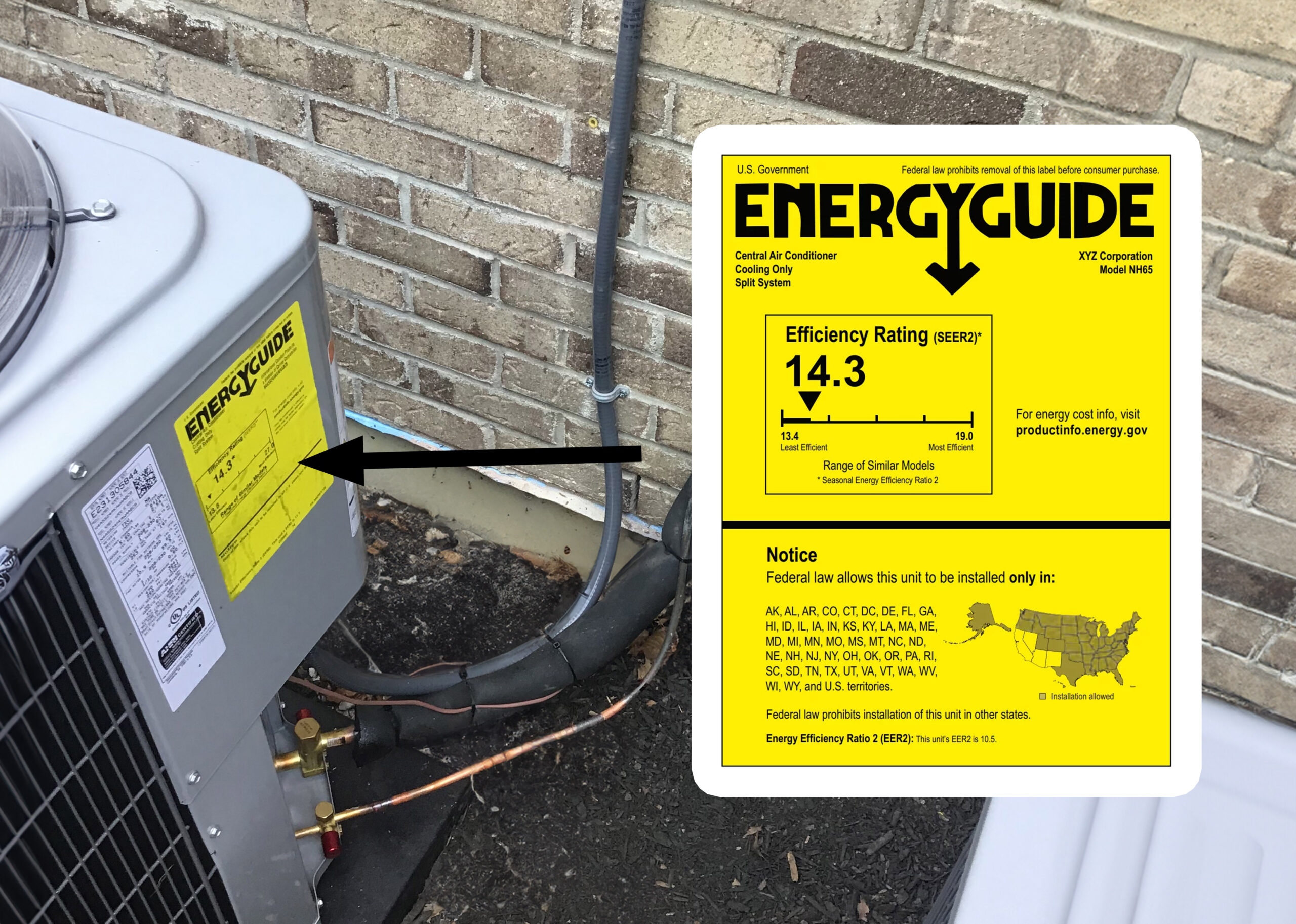

In order to qualify, your HVAC system must be ENERGY STAR certified. This includes meeting SEER2 (Seasonal Energy Efficiency Ratio) and EER2 (Energy Efficiency Ratio) requirements for air conditioners. Heat pumps must also meet HSPF2 (Heating Seasonal Performance Factor) requirements.

Furnaces need to meet AFUE (Annual Fuel Utilization Efficiency) standards to qualify. While water heaters must meet UEF (Uniform Energy Factor) or EF (Energy Factor) ratings, depending on the type of system.

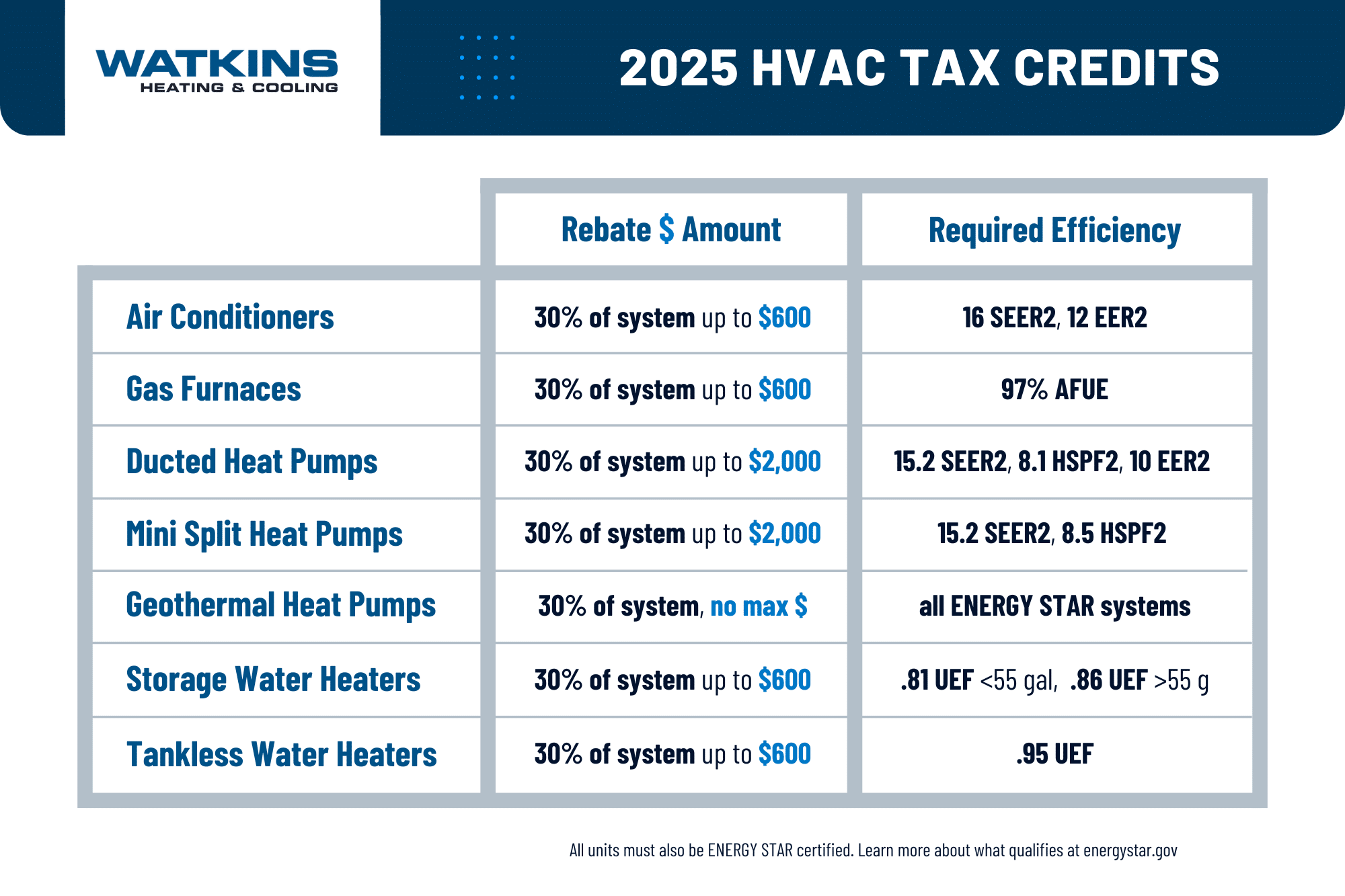

Here’s a closer look at the specific ratings your HVAC system needs in order to be eligible for tax rebates in 2025:

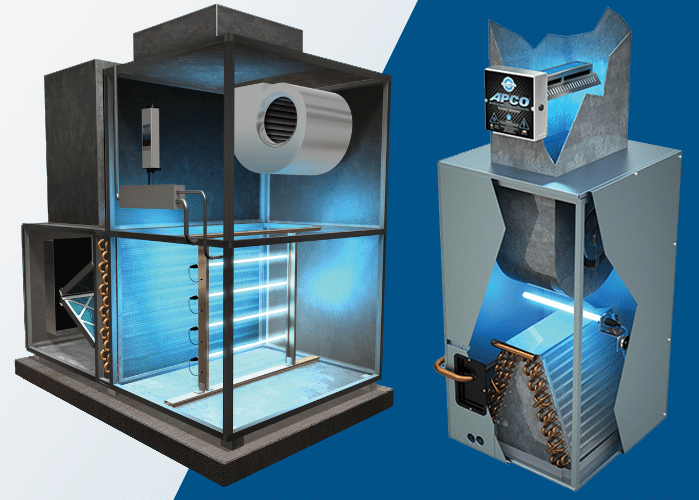

1. Central Air Conditioners

- Tax Credit Amount: Up to $600. This rebate covers 30% of your system’s total cost, but is capped at $600.

- Requirements: To qualify for the 2025 federal tax credit, central air conditioner systems must have a rating of at least 16 SEER2 and 12 EER2. They must also be ENERGY STAR certified. This SEER2 minimum applies to split systems, while packaged systems automatically qualify as long as they are ENERGY STAR certified.

- Benefits: Central air conditioning systems are essential for maintaining comfort during Ohio’s hot summers. This tax credit can help offset the cost of upgrading to a new, energy-efficient air conditioning system.

2. Gas Furnaces

- Tax Credit Amount: Up to $600. This rebate covers 30% of your system’s total cost, but is capped at $600.

- Requirements: To qualify for the 2025 federal tax credit, gas furnace systems must have a rating of at least 97%AFUE. They must also be ENERGY STAR certified.

- Benefits: High-efficiency gas furnaces reduce energy consumption while providing cozy warmth. With the available tax rebates, they’re a great investment for Ohio homeowners looking to stay warm and save money during cold winters.

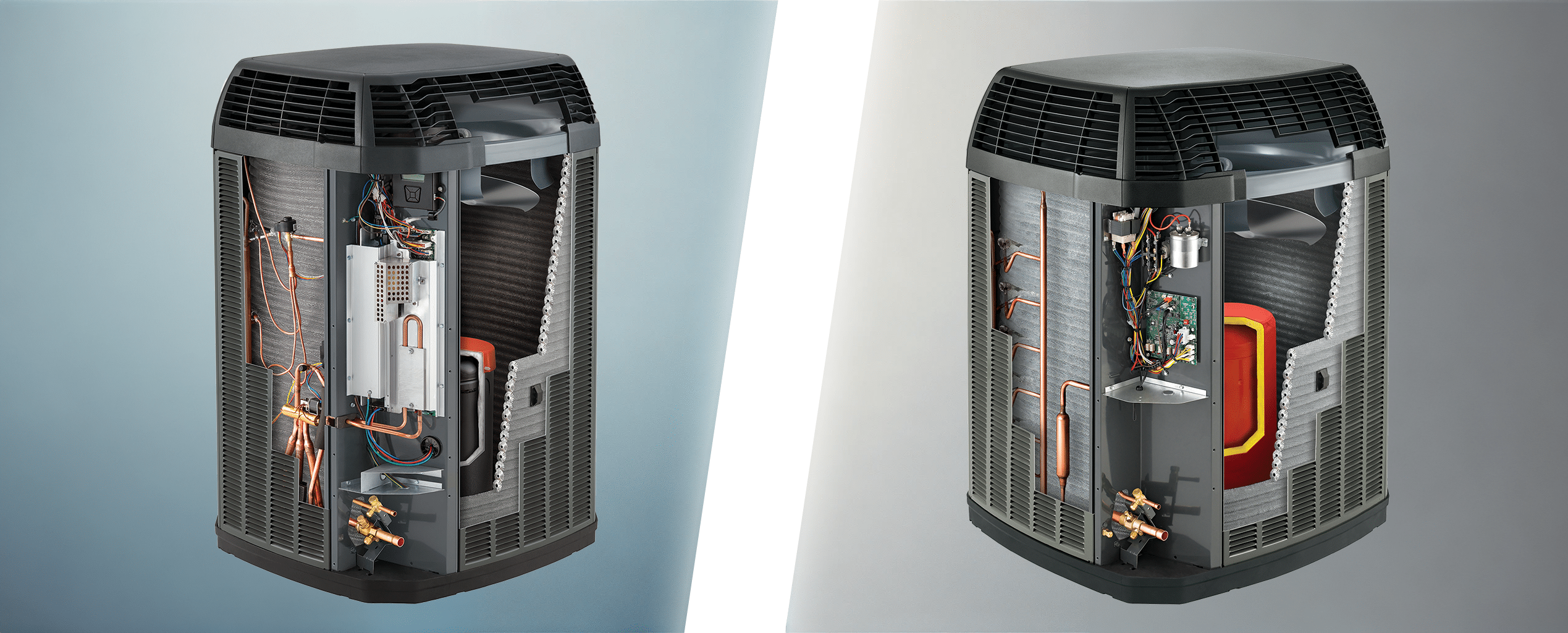

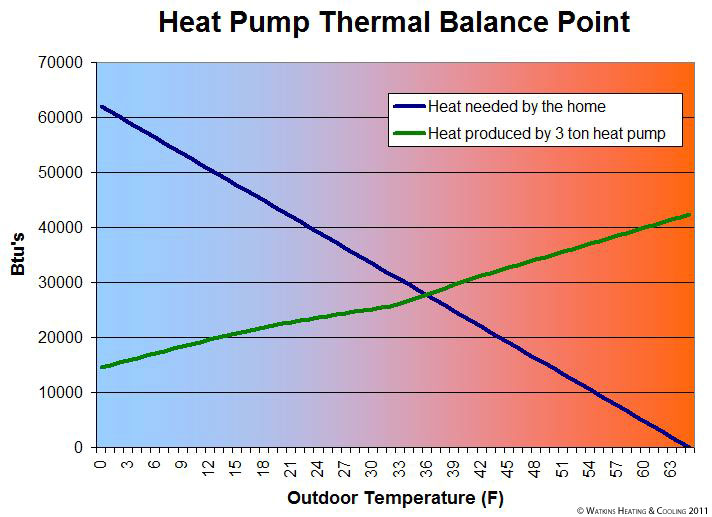

3. Air Source Heat Pumps

- Tax Credit Amount: Up to $2,000. This rebate covers 30% of your system’s total cost, but is capped at $2,000.

- Requirements: To qualify for the 2025 federal tax credit, ducted heat pump systems must have a rating of at least 15.2 SEER2, 8.1 HSPF2, and 10 EER2. Ductless (mini-split) heat pumps have a slightly higher requirement. Ductless heat pump systems must have a rating of at least 15.2 SEER2 and 8.5 HSPF2 for the tax credit. Both types of air source heat pumps must also be ENERGY STAR certified

- Benefits: Cold climate and mini-split heat pumps are highly efficient and provide yearlong comfort through both heating and cooling for your home. With the heat pump tax credit, you can significantly reduce the upfront costs of installing a new system. If you’re trying to decide which cooling system to buy, check out our article on Heat Pump vs. Air Conditioners.

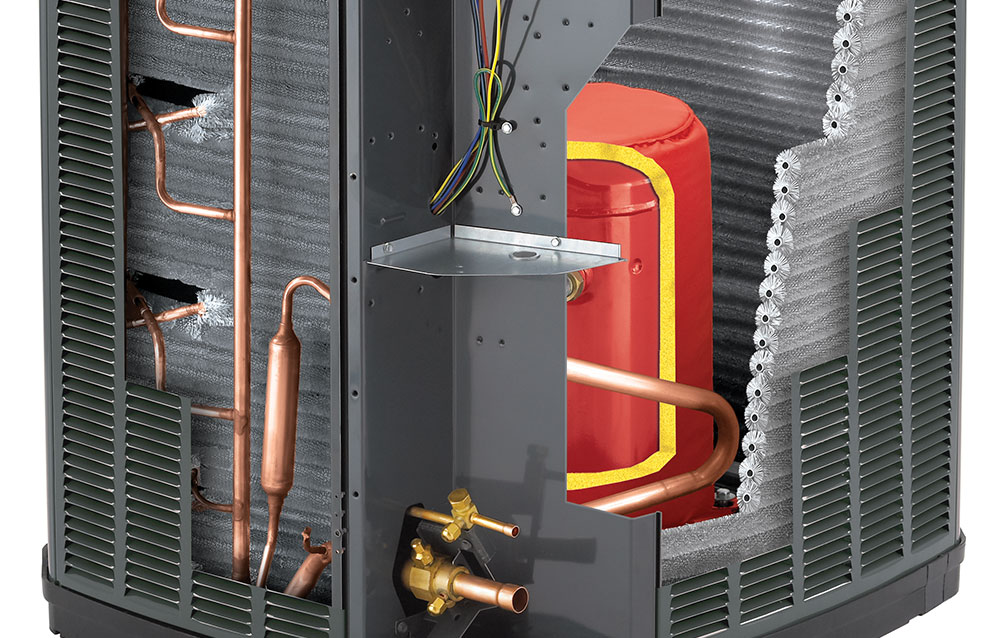

4. Geothermal Heat Pumps

- Tax Credit Amount: 30% of your installed job. This HVAC federal tax credit has no cap, so if you spent $20k on your geothermal heat pump system job, you would be eligible for a $6,000 rebate. This includes equipment, labor, related ductwork, and installation of the ground-source water loop.

- Requirements: All geothermal heat pumps that are ENERGY STAR certified qualify for the 2025 federal tax credit.

- Benefits: Geothermal heat pumps are extremely energy efficient and provide reliable comfort year-round. Plus, these systems last a long time, making them a smart investment. With the geothermal tax credit, you can save a lot on installation. For more details about these systems, check out our Geothermal Heat Pump page.

5. Water Heaters

- Tax Credit Amount: Up to $600. This rebate covers 30% of your system’s total cost, with $600 being the maximum amount.

- Requirements: To qualify for the 2025 federal tax credit, tankless water heaters must have a rating of at least .95 UEF. Requirements for water heaters with tanks are a bit different. Gas storage water heaters must have a rating of at least .81 UEF for tanks less than 55 gallons, and at least .86 UEF for tanks of 55 gallons or more. Both types of water heaters must be ENERGY STAR certified.

- Benefits: Cold climate and mini-split heat pumps are highly efficient and provide yearlong comfort through both heating and cooling for your home. With the heat pump tax credit, you can significantly reduce the upfront costs of installing a new system. If you’re trying to decide which cooling system to buy, check out our geothermal heat pump pricing here.

CenterPoint Energy Utility Rebates for the Dayton, Ohio Area

* Important Update *

* As of Friday, November 1st, 2024, CenterPoint Energy has discontinued the program below. *

In addition to the federal tax credits above, homeowners in Dayton, Ohio and northern Cincinnati, Ohio can also take advantage of utility rebates offered by CenterPoint Energy.

As we’ll discuss in the next section, electric energy rebates have been discontinued in Ohio, but some gas HVAC rebates are still available. If your home uses CenterPoint Energy’s natural gas as the primary heating source, you may qualify for the rebates listed below.

Furnaces:

- $400 rebate for Natural Gas Furnace with 97% AFUE or higher

- $150 rebate for Natural Gas Furnaces with 95% AFUE – 96.99% AFUE

Gas Boilers:

- $500 rebate for Gas Boilers with 95% AFUE or higher; Input capacity must be less than 300 MBTUH

Water Heaters:

- $250 rebate for Natural Gas Tankless Water Heater with a .90 Energy Factor (EF) or higher

- $100 rebate for Natural Gas Tank Storage Water Heater with a .67 Energy Factor (EF) or higher

Thermostats:

- $50 rebate for “Smart” Wi-Fi enabled thermostat with presence-sensing or geo-fencing capabilities

- $30 rebate for “Basic” Wi-Fi enabled thermostat with Wi-Fi capability for programming and adjusting remotely.

You can see CenterPoint’s specific product eligibility, requirements, and disclaimers here.

AES and Duke Energy Utility Rebates for Dayton and Cincinnati, Ohio

Homeowners in Dayton, Ohio used to have access to utility rebates offered by AES (formerly DP&L), while those in Cincinnati, Ohio could benefit from the Duke Energy Smart $aver® Program.

However, as of 2020, Ohio House Bill 6 has caused AES and Duke Energy to discontinue their energy efficiency incentive programs. This means these companies can no longer offer rebates for energy-efficient HVAC upgrades in Ohio.

How to Claim Your HVAC Tax Credits

Claiming your HVAC tax credits is straightforward but requires careful attention to detail. Here is a step-by-step guide on how to get your rebate.

- Verify Eligibility: Ensure your new HVAC system meets the energy efficiency requirements specified by the IRS. Your HVAC contractor should provide the necessary documentation, including the reference number for your AHRI certificate of performance. Always make sure to check if your system has the qualified energy efficient improvements before you purchase it. In the next section, we’ll cover how some contractors may mislead you by skipping this step.

- File with Your Tax Return: When filing your taxes, you will need to complete IRS Form 5695, “Residential Energy Credits,” to claim the tax credit. Remember to keep all documentation from the purchase of your system, including the invoice from your HVAC contractor and the AHRI number, in case of an audit.

- Consult a Tax Professional: To get personalized advice and ensure you’re maximizing your savings, consult a tax professional familiar with energy-efficient home improvements.

Beware of False Tax Credit Promises

Some HVAC contractors might promise a tax credit on their proposal, but the system they’re selling you may not fully meet ENERGY STAR requirements. Sometimes, one unit qualifies, but not the entire system. While their invoice may claim it qualifies, this isn’t the same as a legally recognized certificate and could lead to issues when you file your taxes.

We’ve seen homeowners misled by other HVAC contractors, believing their system qualified, only to be audited by the IRS and discover they lacked the required AHRI Certificate. Without this documentation, they faced penalties, and the contractor refused to help, simply reminding them they’d advised consulting a tax professional. At Watkins, we provide your AHR number upfront in your contract to confirm your system qualifies for tax rebates. Our proposals include the necessary ratings, stipulations, and AHRI number to ensure everything meets the requirements for your taxes.

Why Energy Efficiency Matters

In 2025, homeowners have a great opportunity to improve their home’s energy efficiency and save money by investing in energy-efficient HVAC systems. These systems qualify for federal tax credits and provide long-term savings by reducing energy consumption, lowering utility bills, and decreasing your carbon footprint. Whether you’re considering air source heat pumps, central air conditioners, or gas furnaces, the financial incentives available can help offset installation costs, making it a smart investment.

In addition to federal tax credits and utility rebates, Watkins Heating & Cooling offers exclusive rebates and special offers through our partnerships with manufacturers. Check out our special Watkins deals and rebates here.

For more information on how much you can save with a new HVAC system or to schedule a consultation, visit our Air Conditioner Pricing Page. Our team at Watkins Heating & Cooling is here to help you navigate the process and find the best solutions for your home.